Is there method to Marlins' spending madness?

Some believe plan is to drive up value of franchise for future sale

Phil Rogers

3:43 PM CST, February 11, 2012

With a flair for showmanship rarely seen outside the Westminster Kennel Club Dog Show, the Marlins gave Yoenis Cespedes the full Albert Pujols treatment on Wednesday.

Also, upon arriving at Miami International Airport from the Dominican Republic, Cespedes said that "hopefully'' he would play for the Marlins, pointing out there are "a lot of Cubans (here) and they would support me a lot.'' So, case closed, right?

Wrong.

While conventional wisdom suggests the Marlins have supplanted the Cubs as front-runners for the Cuban prospect, the reality is these negotiations are like those that led to Prince Fielder signing with the Tigers. Developments beneath the surface, those that are kept private, will prove to be the most significant ones, not those for the benefit of television cameras and print reporters.

With the large Cuban community in South Florida, the Marlins are the one team with a possible losing position on Cespedes. They could alienate that group of fans if they didn't appear aggressive in their pursuit of the Cuban center fielder after investing so heavily in Jose Reyes, Mark Buehrle and Heath Bell.

Fans of the Cubs, White Sox, Tigers, Orioles and Athletics might be disappointed at the end of the Cespedes sweepstakes. But no team other than the Marlins fears it could look bad for a decade if Cespedes develops into a perennial All-Star elsewhere.

Marlins owner Jeffrey Loria and President David Samson were thrilled agent Adam Katz gave them such public access to his client. But while Cespedes was touring the new Marlins Park in Little Havana, executives with other teams were rolling their eyes about a wave of irresponsible spending that parallels the Cubs' spending spree as Tribune Co. worked to end the World Series drought and push the price of the franchise beyond $1 billion.

Loria joined the Angels' Arte Moreno and the Tigers' Mike Ilitch as an owner making a difference for his team this offseason. But in adding Pujols and Fielder, the Angels and Tigers are increasing their combined 2012 payrolls by 13 percent (Pujols has a heavily back-loaded contract).

The Marlins, who also back-loaded the Reyes, Buehrle and Bell contracts, essentially are going for the rare 100 percent increase — even more if they do sign Cespedes.

With Hanley Ramirez as the only player earning $10 million-plus, they were at a well-managed $57.7 million to start last season. They're sitting at a minimum of about $101 million now (even with the Cubs paying roughly $16.45 million of Carlos Zambrano's $19 million) and that figure jumps to $116.5 million if you judge Reyes, Buehrle and Bell by their annual averages rather than actual salaries.

The easy answer here is Loria has more money to spend because of the new ballpark and an anticipated increase in broadcast revenue. But does he really have this much more money?

The stadium is a public-private partnership. Loria only got his long-awaited ballpark after agreeing to pay $155 million of the $515 million projected cost. That only makes the spending binge more curious.

This will be the 14th new major league stadium to be opened since 2000. The other teams increased their payroll by an average of 17.9 percent from the last year in their old home to the first year in their new home.

Using that calculation, the Marlins would have figured to start 2012 with a $68 million payroll. They blew past that in signing Reyes and have just kept spending.

How's this going to end? Some skeptics believe Loria will sell the team within the next five years — possibly as early as 2014 — and cash out, possibly allowing him to trade up for the Mets.

After originally buying an interest in the Montreal Expos for $12 million in December 2000, Loria sold them to Major League Baseball for $120 million only two years later. He used that capital to finance a $143 million purchase of the Marlins, who were being sold so then-owner John Henry could buy the Red Sox.

Forbes estimated the value of the Marlins at $360 million last year. That value could jump significantly. There's a pattern here, and it isn't pointing toward long-term stability.

Some believe plan is to drive up value of franchise for future sale

Phil Rogers

3:43 PM CST, February 11, 2012

With a flair for showmanship rarely seen outside the Westminster Kennel Club Dog Show, the Marlins gave Yoenis Cespedes the full Albert Pujols treatment on Wednesday.

Also, upon arriving at Miami International Airport from the Dominican Republic, Cespedes said that "hopefully'' he would play for the Marlins, pointing out there are "a lot of Cubans (here) and they would support me a lot.'' So, case closed, right?

Wrong.

While conventional wisdom suggests the Marlins have supplanted the Cubs as front-runners for the Cuban prospect, the reality is these negotiations are like those that led to Prince Fielder signing with the Tigers. Developments beneath the surface, those that are kept private, will prove to be the most significant ones, not those for the benefit of television cameras and print reporters.

With the large Cuban community in South Florida, the Marlins are the one team with a possible losing position on Cespedes. They could alienate that group of fans if they didn't appear aggressive in their pursuit of the Cuban center fielder after investing so heavily in Jose Reyes, Mark Buehrle and Heath Bell.

Fans of the Cubs, White Sox, Tigers, Orioles and Athletics might be disappointed at the end of the Cespedes sweepstakes. But no team other than the Marlins fears it could look bad for a decade if Cespedes develops into a perennial All-Star elsewhere.

Marlins owner Jeffrey Loria and President David Samson were thrilled agent Adam Katz gave them such public access to his client. But while Cespedes was touring the new Marlins Park in Little Havana, executives with other teams were rolling their eyes about a wave of irresponsible spending that parallels the Cubs' spending spree as Tribune Co. worked to end the World Series drought and push the price of the franchise beyond $1 billion.

Loria joined the Angels' Arte Moreno and the Tigers' Mike Ilitch as an owner making a difference for his team this offseason. But in adding Pujols and Fielder, the Angels and Tigers are increasing their combined 2012 payrolls by 13 percent (Pujols has a heavily back-loaded contract).

The Marlins, who also back-loaded the Reyes, Buehrle and Bell contracts, essentially are going for the rare 100 percent increase — even more if they do sign Cespedes.

With Hanley Ramirez as the only player earning $10 million-plus, they were at a well-managed $57.7 million to start last season. They're sitting at a minimum of about $101 million now (even with the Cubs paying roughly $16.45 million of Carlos Zambrano's $19 million) and that figure jumps to $116.5 million if you judge Reyes, Buehrle and Bell by their annual averages rather than actual salaries.

The easy answer here is Loria has more money to spend because of the new ballpark and an anticipated increase in broadcast revenue. But does he really have this much more money?

The stadium is a public-private partnership. Loria only got his long-awaited ballpark after agreeing to pay $155 million of the $515 million projected cost. That only makes the spending binge more curious.

This will be the 14th new major league stadium to be opened since 2000. The other teams increased their payroll by an average of 17.9 percent from the last year in their old home to the first year in their new home.

Using that calculation, the Marlins would have figured to start 2012 with a $68 million payroll. They blew past that in signing Reyes and have just kept spending.

How's this going to end? Some skeptics believe Loria will sell the team within the next five years — possibly as early as 2014 — and cash out, possibly allowing him to trade up for the Mets.

After originally buying an interest in the Montreal Expos for $12 million in December 2000, Loria sold them to Major League Baseball for $120 million only two years later. He used that capital to finance a $143 million purchase of the Marlins, who were being sold so then-owner John Henry could buy the Red Sox.

Forbes estimated the value of the Marlins at $360 million last year. That value could jump significantly. There's a pattern here, and it isn't pointing toward long-term stability.

So...

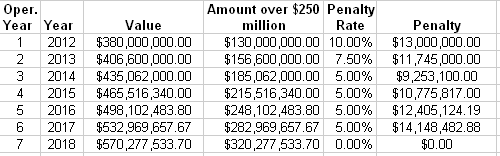

The Baseball Stadium Agreement between the County and Marlins has the Payment Upon Sale of the Team Clause. If Loria were to sell the club, he would have to split a percentage with the County for every dollar over $250 million.

The Marlins will be worth ~$380 million when Forbes publishes their yearly numbers in March. Here are some estimates to consider. I'm assuming 7% growth in value, which is a conservative estimate when it comes to the value of sports franchises.

Comment